Series: How to Read a Bond Indenture — A Value Investor’s Framework

Introduction

When investors say a bond is “senior,” they usually stop thinking right there.

That is a mistake.

In modern corporate structures, legal seniority does not determine recovery.

Structural position does.

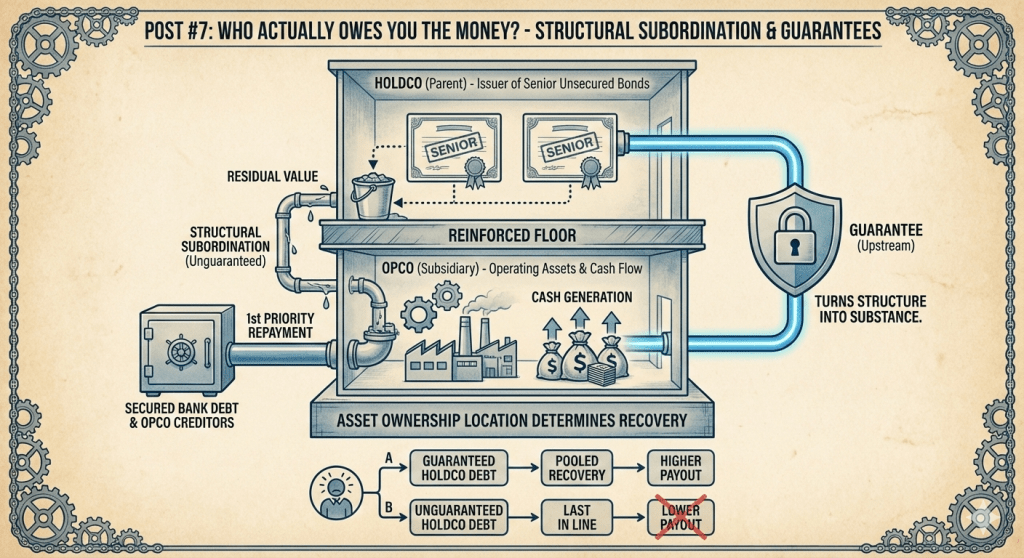

Two bonds can both be labeled senior unsecured yet one recovers 70 cents on the dollar in distress, while the other recovers 10. The difference is not credit quality. It is where the bond sits in the corporate architecture.

This post explains how guarantees, subsidiaries, and structural subordination determine who truly owes you money and who gets paid first when things go wrong.

1. Legal Seniority vs. Structural Seniority

Let’s establish the key distinction.

Legal Seniority

- Defined within the same legal entity

- Senior > subordinated > equity

- Applies only inside one balance sheet

Structural Seniority

- Determined by where the debt is issued

- Depends on:

- Parent vs subsidiary

- Operating company vs holding company

- Asset ownership location

In bankruptcy, cash flows upward, not sideways.

Whoever sits closest to the assets gets paid first — regardless of legal labels.

2. Holding Company vs Operating Company (The Core Trap)

Many public companies are structured as follows:

- HoldCo (Parent):

- Issues public bonds

- Owns equity in subsidiaries

- Has no operations

- OpCo (Subsidiary):

- Owns assets

- Generates cash flow

- Employs workers

- Often issues bank debt

If you own HoldCo debt and the OpCo issues secured or senior debt, you are structurally subordinated, even if your bond is labeled “senior.”

Why This Matters in Distress

In bankruptcy:

- OpCo creditors are paid first from OpCo assets

- Only residual value flows to HoldCo

- HoldCo bondholders fight over what’s left

This is why:

Senior unsecured HoldCo debt can recover less than secured OpCo debt even when issued by the same corporate group.

3. Guarantees: Turning Structure Into Substance

A guarantee legally obligates another entity to repay the debt if the issuer cannot.

Guarantees collapse structural distance.

Types of Guarantees

Upstream Guarantee

- Subsidiary guarantees parent debt

- Strong protection for bondholders

- Pulls operating assets into recovery pool

Downstream Guarantee

- Parent guarantees subsidiary debt

- Common

- Less helpful for HoldCo bondholders

Cross-Guarantees

- Multiple subsidiaries guarantee each other

- Typical in leveraged credit

- Improves recovery consistency

Strong vs Weak Guarantee Language

Strong guarantees:

- Are unconditional

- Are joint and several

- Survive restructuring

- Cover all payment obligations

Weak guarantees:

- Are limited

- Can be revoked

- Exclude certain subsidiaries

- Terminate upon asset sales

Always verify:

Which legal entities are guarantors and which are excluded.

4. Non-Guarantor Subsidiaries: Where Value Leaks

One of the most dangerous phrases in an indenture is:

“Certain subsidiaries are designated as non-guarantors.”

This allows:

- Assets to sit outside the creditor pool

- Cash flow to bypass bondholders

- Value to be structurally isolated

Common Justifications

- Foreign subsidiaries

- Regulated entities

- Joint ventures

Credit Reality

Non-guarantor subsidiaries often:

- Hold profitable assets

- Generate stable cash flow

- Remain untouched in restructuring

Bondholders then discover:

The assets they thought backed the bond legally never did.

5. Structural Subordination in Practice

Let’s compare two simplified structures.

Structure A- Guaranteed Debt

- Parent issues bonds

- All operating subs guarantee

- Assets pooled

- Unified recovery

Structure B- Unguaranteed HoldCo Debt

- Parent issues bonds

- OpCos issue bank debt

- No guarantees

- Bondholders rely on dividends

In distress:

- Structure A bondholders participate in asset recovery

- Structure B bondholders are last in line

Same issuer. Same coupon. Same rating.

Completely different outcomes.

6. Why Ratings Often Miss Structural Risk

Ratings agencies:

- Focus on consolidated financials

- Assume capital fungibility

- Underweight legal entity separation

But bankruptcy courts do not consolidate by default.

Recovery depends on:

- Entity-by-entity balance sheets

- Intercompany claims

- Guarantee enforceability

This is why sophisticated credit investors:

Read the legal structure before reading the income statement.

7. Real-World Pattern: Why Bank Debt Always Wins

Banks insist on:

- OpCo issuance

- Asset liens

- Guarantees

- Covenants controlling asset movement

Public bondholders often accept:

- HoldCo issuance

- No guarantees

- Broad subsidiary exclusions

This is not accidental.

It reflects negotiating power, not risk neutrality.

8. How to Read This Section of an Indenture

When reviewing guarantees and subsidiaries, identify:

- Issuing entity

- List of guarantors

- Non-guarantor subsidiaries

- Conditions under which guarantees can be released

- Whether future subs must guarantee

- Whether asset sales terminate guarantees

- Whether guarantees survive mergers

Ask one blunt question:

Do I have a legal claim on the operating assets or only on dividends?

9. Value Investor Interpretation

Structural subordination explains why:

- “Senior” bonds still suffer large losses

- Recovery estimates vary wildly

- Two bonds from the same issuer trade at different yields

For the value investor, guarantees are not legal formalities they are the difference between credit and speculation.

If you are not guaranteed by the entities that generate cash, you are not underwriting a business you are underwriting organizational goodwill.

Conclusion

Credit losses are rarely caused by bad math.

They are caused by bad structure.

Understanding guarantees and subsidiaries allows you to:

- See through misleading seniority labels

- Estimate real recovery value

- Avoid structurally junior traps

- Demand yield for hidden risk

This is where bond analysis stops being academic and becomes defensive capital allocation.

Next in the Series

Post #8 — Events of Default, Acceleration & Trustee Powers: What Actually Happens After a Breach

We’ll cover:

- Payment vs covenant defaults

- Cure periods

- Acceleration mechanics

- Trustee limitations

- Why many defaults don’t lead to immediate recovery

Leave a reply to Anonymous Cancel reply