Brace yourself for a deep read. Bonds are often called the “smart money” of the market. Why? Because their prices reflect what sophisticated investors (Bill H. Gross) are willing to pay for predictability, risk, and opportunity. Understanding bonds means understanding how the market values certainty itself.

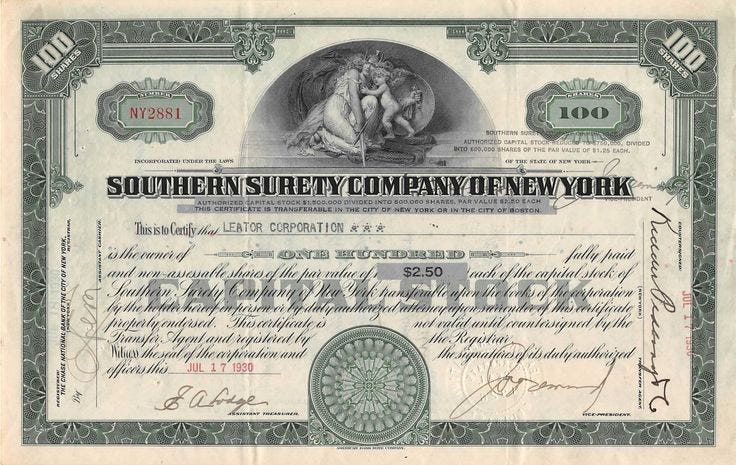

Before diving into numbers, let’s see what a bond really is. At its core, a bond is a promise. It is a legal contract, called an indenture, that spells out exactly what the issuer owes you and when. Buying a bond means lending money to a government, a company, or another borrower. While the concept is simple, each bond carries lessons about time, risk, and decision-making. In the sections that follow, we will break a bond down into its key components. These include coupons, price, yield, duration, and special features. This breakdown will help you see exactly what you own and how markets value it.

Jargon Cheat Sheet

Before we dive into coupons, prices, and yields, let’s get familiar with the key words that make up a bond:

- Par Value / Face Value: This is the amount the issuer promises to pay you at maturity. Think of it as the official price of the bond, usually $1,000 for corporate bonds.

- Coupon: The regular interest payment the bond makes. Usually expressed as a percentage of the face value. This is your predictable cash flow.

- Maturity: The date when the bond expires and the issuer returns your principal. Bonds can be short-term (a few months), medium-term (a few years), or long-term (10+ years).

- Price: What you actually pay for the bond in the market. It can be above (premium) or below (discount) the par value depending on interest rates, credit risk, and demand.

- Yield: The effective return you earn, given the bond’s price, coupon, and time to maturity. There are several types of yield (YTM, YTC, etc.) we’ll explore later.

- Call / Put Features: Some bonds can be called (redeemed early) or put (sold back to the issuer). These features give flexibility to the issuer or investor but also affect predictability.

- Indenture: The legal contract that defines all the terms of the bond. It’s the fine print that ensures the issuer keeps their promises or tells you what happens if they don’t.

Understanding these terms makes everything else about bonds easier to follow. Think of this section as your bond glossary the cheat sheet that will make coupons, yields, and duration less intimidating.

How Bonds Pay You

The most visible part of a bond is its coupon—the regular interest payment you receive for lending your money. Coupons are usually paid every six months and expressed as a percentage of the bond’s face value, making it easy to calculate expected income.

Example: A $1,000 bond with a 4% annual coupon pays $40 per year, split into two payments of $20 every six months. You know exactly when the money will arrive and how much it will be.

The coupon is more than just a number. It reflects the balance between the issuer’s need to borrow and your desire for predictable income:

- Higher coupons: More income, often reflecting greater default risk or special features.

- Lower coupons: Less income, suggesting safety and predictability.

In essence, the coupon turns a bond from a simple promise into a series of known cash flows—the tangible way bonds deliver certainty.

Price

A bond’s price is determined by supply and demand, which reflects interest rates, creditworthiness, and the desire for predictable income.

- When interest rates fall, bonds with higher coupons become more attractive, and prices rise.

- When rates rise, bonds with lower coupons lose appeal, and prices fall.

Example: A $1,000 bond with a 4% annual coupon:

| Face Value | Coupon | Market Price | Yield |

|---|---|---|---|

| $1,000 | 4% ($40/yr) | $1,000 | 4% |

| $1,000 | 4% ($40/yr) | $1,100 | 3.6% |

| $1,000 | 4% ($40/yr) | $900 | 4.4% |

Yield

A bond’s yield links its price to the return you earn:

- Buy at face value → yield = coupon rate.

- Price rises → yield falls.

- Price falls → yield rises.

Inflation risk also matters. Predictable cash flows lose real value if inflation outpaces your yield. For example, a 3% yield feels safe, but 4% inflation erodes purchasing power.

Key Yield Metrics

Coupons and price alone don’t tell the whole story. Yield metrics account for price, time, and bond features, giving a complete picture of what you actually earn:

- Yield to Maturity (YTM): Total annualized return if held to maturity, including price, coupons, and principal.

- Example: Buy a $1,000 bond with 5% coupon for $950. You still get $50/year + $1,000 at maturity, so effective yield > 5%.

- Yield to Call (YTC): Return assuming the bond is redeemed early by the issuer.

- Example: A 10-year callable bond may be called after 5 years if rates drop. Your actual yield may align closer to YTC than YTM.

- Current Yield: Annual coupon ÷ current price. Quick snapshot of income, ignoring price changes or principal.

- Yield to Worst (YTW): Lowest possible yield if the bond is called or matures early—a conservative measure of minimum return.

These metrics allow investors to compare bonds with different prices, maturities, and features. They help translate price, coupon, and duration into a full picture of return potential.

Duration

Duration measures how much a bond’s price is likely to change when interest rates move. It gives you a sense of a bond’s sensitivity to rate changes and the effect of time on your investment.

- Interest rates determine the value of a bond’s fixed payments in the market.

- When rates rise, existing bonds with lower coupons become less attractive, and their prices fall.

- When rates fall, the opposite happens.

Example: A two-year bond vs. a ten-year bond, both with similar coupons:

- 1% rise in rates → two-year bond loses ~2% of value.

- 1% rise in rates → ten-year bond loses ~9% of value.

Longer duration amplifies interest rate sensitivity because cash flows are further into the future. Duration is a magnifying glass for rate risk.

Credit Risk

Credit risk is the chance that the issuer might not pay interest or return your principal. Degree of risk varies by borrower:

- U.S. Treasury bonds: Very low risk.

- Strong corporate bonds: Low risk.

- Smaller/financially weaker companies: Higher risk → higher coupon.

Credit ratings (Moody’s, S&P, Fitch) provide standardized risk measures, but market perception can differ. Recovery rates after default vary.

Key points:

- Credit risk affects coupon and yield.

- Higher risk generally demands higher yield.

- Not all promises are equal—understanding the issuer is as important as knowing cash flows.

Callable Bonds

Callable bonds allow the issuer to repay early:

- Issuer repays principal before maturity.

- Investors lose some expected interest payments.

- Higher coupons compensate for this risk.

- Introduces reinvestment risk if rates drop.

Example: There is a ten-year bond with a 5% coupon. Rates fall to 3% after 5 years. The bond is called, so the investor gets the principal back early.

Callable bonds show that even bonds have layered risks.

Convertible Bonds: Bonds That Can Become Stock

Convertible bonds can be exchanged for company stock:

- Combine steady income + potential equity upside.

- Value depends on creditworthiness and stock price.

- Risks: equity risk, interest rate/duration risk, opportunity cost.

Example: $1,000 convertible bond allows exchange for 50 shares. Stock rises → conversion may be better than coupons alone. Stock falls → still get predictable income.

Bonds Comparisons

| Feature | U.S. Government Bond | Corporate Bond (AAA) | Callable Corporate Bond | Convertible Bond |

|---|---|---|---|---|

| Face Value | $1,000 | $1,000 | $1,000 | $1,000 |

| Coupon | 3% ($15 every 6 months) | 5% ($25 every 6 months) | 6% ($30 every 6 months) | 4% ($20 every 6 months) |

| Duration | 10 years | 10 years | 10 years | 10 years |

| Credit Risk | Very low | Low | Low to moderate | Low |

| Special Feature | None | None | Callable after 5 years | Convertible to 50 shares |

Key takeaways:

- Government bonds = steady, predictable, very low default risk.

- Corporate bonds = higher yield, slightly higher credit risk.

- Callable bonds = higher coupons, but cash flow may change.

- Convertible bonds = moderate coupons + option to convert to stock.

Bonds as Benchmark

Bonds provide a standard for evaluating other investments:

- Example: Ten-year U.S. Treasury = 3% yield → baseline.

- Corporate bond offering 5% → compensates for extra credit risk.

- Tech stock with 8% potential return → shows trade-off between certainty and upside.

Understanding benchmarks clarifies opportunity cost and trade-offs, helping investors measure risk, patience, and return expectations.

Conclusion

By examining coupons, price, yield, duration, credit risk, callability, and convertibility, we see the full story behind bonds. They reveal how markets value predictability. Time and interest rates affect cash flows. Special features change outcomes. Bonds teach patience, planning, and decision-making. They are mirrors reflecting the cost of certainty.

Other forms to explore: inflation-protected bonds, zero-coupon bonds, municipal bonds, floating-rate bonds. Each has unique mechanics and trade-offs. Future posts will break these down.

Bonds offer clarity in uncertainty. They show trade-offs, patience, and opportunity cost. Understanding bonds equips investors to make smarter, informed decisions.

Leave a reply to Anonymous Cancel reply