What Kodak Forgot

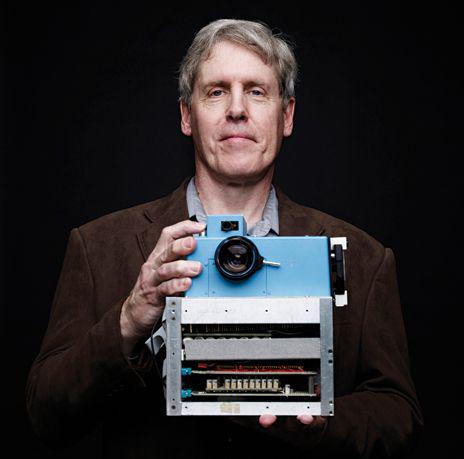

In 1975, a young Kodak engineer named Steve Sasson built the world’s first digital camera. By today’s standards it was clunky, about the size of a toaster, but it worked. He showed it to management.

Their response?

“That’s cute. But don’t tell anyone.”

Why? Because Kodak’s empire was built on film. Film meant recurring revenue from rolls, processing, and printing. A digital camera threatened all of it.

So they buried the idea.

That single decision cost them everything.

By the early 2000s, digital photography exploded. Sony, Canon, and eventually Apple embraced it. Kodak, once controlling 90 percent of the U.S. film market, filed for bankruptcy in 2012.

They didn’t fail because they couldn’t see the future. They failed because they ignored it.

That’s opportunity cost in its most devastating form. The price of what could have been, but wasn’t.

Opportunity Cost, Made Simple

Every decision is a trade-off.

Say you can expand your business into a new region with an expected return of 10 percent. Or you can buy a U.S. government bond yielding 5 percent with no risk.

Choosing one means giving up the other. That difference, what you forgo, is the opportunity cost.

But it is not only about comparing numbers. You have to look at the full picture.

Expansion could bring higher returns, but it could also flop. The bond is safer, but it could leave you exposed to competitors who expand while you sit still.

Opportunity cost forces you to think about ranges of outcomes and ask: What am I giving up by choosing this? And is it worth it?

Opportunity Cost in a 10-K: What Apple Teaches

When you read a 10-K, you are not just scanning numbers. You are studying judgment.

Every capital decision has an opportunity cost. Money spent on a flashy acquisition cannot also fund research and development. Cash tied up in legacy problems cannot build the future.

The question isn’t only “What did they do?” but also “What didn’t they do, and was that the right call?”

As an investor, train yourself to look for trade-offs.

Are they prioritizing quick wins, or investing in long-term growth?

Are they sticking to low-return projects, or making thoughtful bets on breakthroughs?

Are they bogged down in old problems, or creating new capabilities?

These choices rarely jump out of the income statement. But over time, they shape whether a company accelerates or stalls.

Apple’s 10-K is a masterclass in this.

For years, critics slammed Apple for sitting on too much cash. But Apple wasn’t passive. They were waiting for the fat pitch.

In 1996, Apple acquired NeXT for $400 million. It was not only a leadership change. It brought back Steve Jobs and laid the foundation for Apple’s future software, including macOS and iOS.

That deal reshaped the company’s trajectory. It delivered leadership, technology, and talent to build what came next.

Years later, Apple launched the iPhone. That single bet redefined an entire industry.

This wasn’t luck. It was disciplined capital allocation. Knowing when to wait, when to act, and when to swing big.

A Mental Checklist

Ask: What else could I be doing with this capital?

If nothing is better, cash might be your smartest move.

Measure every decision against your best alternative, not just against inaction. Holding has a cost too.

Be suspicious of complacency. Most opportunity costs go unnoticed because the alternative feels unfamiliar or hard to justify.

Revisit your choices regularly. The world changes, and your assumptions should too.

Think in alternatives, not absolutes.

Next time you face a decision in investing, business, or life, don’t just ask “Is this good?” Ask “Is this better than my best alternative?”

That habit is where real edge comes from.

Final Thought

Charlie Munger put it plainly: “To the man with only a hammer, every problem looks like a nail.”

That is why thinking in alternatives matters. Most people keep reaching for the same tools again and again.

Great decision-makers build a full toolbox, not just a hammer.

Kodak stuck with the one tool they knew, even when the world changed. Apple adapted, retooled, and led.

That is how great capital allocators think. Not in absolutes, but in comparisons.

Leave a reply to Himanshu Sharma Cancel reply