The Self-Perpetuating Engine Behind the 2008 Crash and the Post-COVID AI Boom

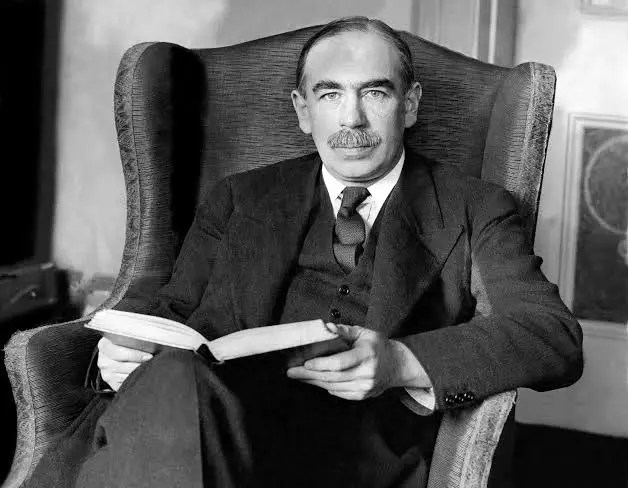

In The General Theory of Employment, Interest and Money, John Maynard Keynes introduced the idea of liquidity preference. A simple but powerful observation that people are not indifferent between holding cash and holding assets. Cash offers certainty, flexibility, and survival in uncertain times. Assets offer return but carry risk. According to Keynes, the interest rate is not merely the price of borrowing money; it is the price required to convince people to give up liquidity. When fear rises, people demand more liquidity and are unwilling to part with cash except at much higher compensation. When fear vanishes, people abandon liquidity and chase returns. What Keynes did not fully live to see is how this preference for liquidity can become self-perpetuating, reinforcing itself into violent crashes on the way down and speculative manias on the way up.

Part I: Liquidity Preference as a Crash Engine — 2008

Financial crises are often described as “credit events” or “leverage unwindings.”

In reality, every true crash is a sudden, violent surge in liquidity preference.

Step 1: Confidence Breaks

In early 2008:

- Subprime losses appeared “contained”

- Then Bear Stearns failed

- Then Interbank trust cracked

Suddenly, the question shifted from:

“What can I earn on my assets?”

to:

“Will I be able to get my money back at all?”

At that moment, liquidity became more valuable than return.

Step 2: Everyone Sells for the Same Reason — Cash

Funds, banks, and institutions began selling not because assets were worthless, but because:

- Redemptions increased

- Margin requirements rose

- Counterparty risk exploded

- Nobody trusted prices anymore

This created a universal mindset:

“I don’t want the highest return. I want certainty.”

That is liquidity preference in its purest form.

Step 3: Selling Begets More Selling (The Reflexive Loop) Soros

Once selling begins:

- Prices fall

- Collateral values drop

- Margin calls increase

- Forced liquidations accelerate

- Volatility spikes

- Bid–ask spreads explode

This feeds directly back into even higher liquidity preference, because falling prices increase fear.

The system enters a self-reinforcing spiral:

- Fear → demand for cash → selling → lower prices → more fear

This is why crashes move so much faster than models predict.

The market is no longer pricing assets.

It is pricing liquidity itself.

Step 4: The Last Phase — Liquidity Over Solvency

By late 2008:

- Institutions with solid long-term assets failed

- Firms were not dying from losses, but from lack of funding

- Markets froze entirely

The defining feature of 2008 was not bad assets.

It was that liquidity disappeared when it was demanded most.

Only when central banks became the buyer and lender of last resort did the spiral finally stop.

Not because assets became good again—

But because emergency liquidity overpowered private liquidity preference.

Part II: The Opposite Spiral — COVID, Free Money, and the AI Boom

Now flip the direction of the same machine.

After COVID, governments and central banks did something unprecedented:

- Zero interest rates

- Trillions in fiscal stimulus

- Unlimited quantitative easing

- Direct deposits into consumer accounts

This was not just stimulus.

It was a global suppression of liquidity preference.

Step 1: Cash Became “Worthless” to Hold

When:

- T-bills yield near zero

- Inflation rises

- Money is abundant

- Backstops are explicit

Holding cash starts feeling like a guaranteed loss.

The psychological shift becomes:

“If I don’t invest this, I’m falling behind.”

Liquidity preference collapses.

Step 2: Excess Liquidity Has to Go Somewhere

Most of this newly created money did not go into:

- Productive business expansion

- Long-term capital formation

- Real infrastructure

Instead, it flowed into:

- Equities

- Venture capital

- Private credit

- Crypto

- Speculative tech

Why?

Because financial markets absorb liquidity faster than the real economy can.

Step 3: Rising Prices Create Lower Liquidity Preference

As asset prices rise:

- Paper wealth increases

- Volatility feels low

- Risk appears manageable

- Leverage expands

- Returns look effortless

This strengthens the belief:

“I don’t need cash. Markets always recover.”

So liquidity preference falls even further.

This becomes the mirror image feedback loop of a crash:

- Rising prices → less desire for cash → more risk-taking → higher prices → even less desire for cash

Step 4: Why AI Became the Perfect Liquidity Magnet

By 2023–2024, the system was already saturated with speculative capital looking for:

- A compelling narrative

- Large addressable markets

- A technological “certainty” story

AI fit perfectly:

- Exponential growth narrative

- Real productivity potential

- Platform dominance

- High operating leverage

Liquidity surged into:

- Mega-cap tech

- Data centers

- Semiconductor supply chains

- Venture funding

This was not just belief in technology. I am also not claiming that AI is not real.

It was trapped global liquidity seeking a narrative strong enough to justify its existence.

The Core Symmetry: Crash and Boom Use the Same Engine

Crash Phase (2008) | Boom Phase (Post-COVID)

—|—

Fear rises | Fear disappears

Liquidity preference spikes | Liquidity preference collapses

Cash is hoarded | Cash is dumped

Assets sold at any price | Assets bought at any price

Volatility explodes | Volatility is ignored

Leverage unwinds | Leverage expands

These are not different systems.

They are the same system moving in opposite directions.

The Hidden Truth Most Investors Miss

Liquidity does not move because of valuation.

Liquidity moves because of:

- Psychological safety

- Narrative certainty

- Policy signals

- Stability of funding

Keynes understood this long before high-frequency trading, ETFs, and global capital flows.

Markets do not destabilize because people are irrational.

They destabilize because liquidity preference must move together across agents.

And when everyone shifts together, stability disappears.

Why This Matters Going Forward

We are now in a world where:

- Liquidity can be created instantly

- Policy shifts are sudden

- Global capital moves without friction

- Asset prices react before fundamentals adjust

This makes future cycles:

- Faster

- Larger

- More narrative-driven

- More violent on both the upside and downside

Every major market regime change in the next 20 years will still follow this same engine:

A shift in liquidity preference → a reflexive feedback loop → systemic repricing.

The Investor’s Edge from Understanding Liquidity Preference

If you understand liquidity preference, you stop asking:

- “Is this asset cheap or expensive?”

and start asking: - “Is liquidity being hoarded or forced into risk?”

Because:

- Crashes end when liquidity preference peaks

- Bubbles end when liquidity preference hits its floor

And both always reverse.

Read this gem

https://www.amazon.ca/General-Theory-Employment-Interest-Money/dp/0156347113

Leave a comment