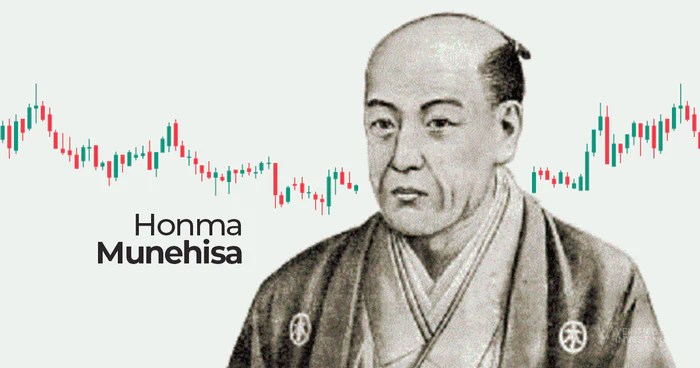

Before modern markets existed, traders needed tools to navigate expectations, fundamentals, and human psychology. Enter Munehisa Homma, an 18th-century Japanese rice merchant, the inventor of candlestick charts.

Homma’s Historical Perspective

- Reading Sentiment: Homma used candlesticks to measure greed and fear in rice markets, grounded in weather, harvest yields, and storage realities.

- Anticipating Expectation Shifts: Patterns helped him predict how collective beliefs about supply and demand might change over weeks or months.

- Timing Trades: He didn’t scalp intraday moves. Instead, he aligned trades with fundamentals and market psychology, buying when prices were undervalued relative to expected supply and selling when prices overreacted.

This disciplined approach made him immensely wealthy, reportedly controlling large portions of the rice market in Sakata. His success came not from luck or chasing small fluctuations, but from understanding market mechanics, fundamentals, and expectations.

Lesson: Charts are mirrors of psychology and expectation, not magic predictors. They only gain meaning when anchored to real value and long-term expectations. Short-term charts show how liquidity is absorbed and market mechanics operate, not where prices are headed.

The Reality of Price and Charts

Many traders stare at candlestick patterns, intraday spikes, and wicks, hoping to uncover hidden signals for consistent profits. For a while, some get lucky. But luck isn’t a method. When markets shift or a black swan hits, those fleeting gains vanish just as quickly as they appeared.

Price is not a signal it’s a reflection. It shows how collective expectations compare to fundamentals. Charts record how people have reacted—sometimes rationally, often emotionally—to evolving beliefs about the future.

“Stock prices move because expectations evolve, not because of technical patterns.”

When the market’s view of a company’s future changes, prices adjust. These changes may occur through new earnings data, shifts in industry trends, or broader economic events. The rest is noise.

By the end of this piece, you’ll understand why short-term trading is largely futile. You will also grasp that the only real forces shaping stock prices over time are the interplay of long-term holders, company fundamentals, and expectations about the future.

Who Really Moves the Market

Short-term traders often assume they can influence prices, but the main forces behind lasting market movements are quite different:

- Long-term holders: Individuals or institutions holding for months or years. Decisions are deliberate, reflecting real expectations of the business.

- Exiting holders: Investors who accumulated stock over years and now wish to sell. Their activity creates supply, not speculation.

- Market makers (MMs): Professionals facilitating trades, managing inventory, and staying neutral. They are engineers of liquidity, not directional speculators.

Short-term traders—scalpers, day traders, momentum chasers are noise relative to real holders. Market makers absorb their activity effortlessly, maintaining neutrality while ensuring that markets function smoothly. Price exists to accommodate real holders, not to create opportunity for intraday gamblers.

How MMs Handle Noise

- Algorithms & High-Frequency Trading: Adjust positions in real time based on short-term flow.

- Liquidity Management Teams: Monitor order books and incoming flow to maintain neutrality.

- Hedging Specialists: Hedge across options, futures, or correlated instruments to neutralize risk.

- Flow Analytics: Predict clusters of stop orders or short-term trades, allowing MMs to place quotes and inventory efficiently.

Key Insight: Short-term traders are “noise” not because MMs ignore them, but because MMs are structured to absorb and manage them systematically. Think of MMs as shock absorbers: small bumps from day traders barely move the market; significant shifts come from long-term holders or fundamental changes.

Even so, there are moments when MMs get temporarily overwhelmed, particularly during periods of intense volatility or dynamic hedging. In those brief windows, prices can move sharply—not because of any new “signal,” but because hedging mechanics create temporary dislocations. Yet these distortions are short-lived; market makers stabilize flows, and prices return to where real supply and demand dictate.

Wicks and Liquidity Zones

Price spikes, long wicks, and sudden reversals often occur around liquidity zones areas where orders cluster, such as stops, limit buys, and limit sells.

- Gamblers’ view: “If it breaks $105, it’s a breakout; I should buy.”

- Reality: That $105 level may represent market makers selling to supply long-term holders entering or exiting positions. Breaks and rejections are often liquidity harvesting, where stops are triggered and real holders are efficiently filled. Wicks on candles simply show temporary absorption of these orders—not a signal about future price movement.

These zones are as visible to market makers as they are to you. A $1,000 order is inconsequential next to millions flowing through these areas. Short-term traders cannot overwhelm them.

Liquidity zones and wicks also reflect the difference between price and expected value. When prices dip or spike briefly, it signals only a temporary over- or under-reaction relative to fundamentals. Market makers are facilitating real holders, not “sending signals” to short-term speculators.

Key Takeaway: Wicks and liquidity zones are mechanical artifacts of the market—they show where liquidity exists and how it is absorbed, not where prices will go next. For traders, these patterns are noise unless used to understand the flow and intentions of long-term holders.

How to Use Charts Correctly

Charts become meaningful only when combined with fundamentals and long-term expectations. They are tools to visualize sentiment and liquidity, not predict exact price moves.

What Charts Show:

- Market Mechanisms at Work: Spikes, wicks, and sudden reversals reflect temporary liquidity absorption by market makers—not intrinsic company value.

- Psychology & Crowds: Charts can reveal periods of excessive greed or fear, helping you gauge when sentiment is over- or under-reacting relative to fundamentals.

- Support and Resistance in Context: Patterns like support or resistance matter only when they align with fundamental value or known liquidity zones.

How to Use Them:

- Identify Favorable Entry Zones: Use dips near support or liquidity clusters to align purchases with value, rather than chasing a breakout.

- Measure Market Temperature: Spot over-exuberance or panic to avoid buying at euphoric highs or selling at irrational lows.

- Time Multi-Week or Multi-Month Decisions: Look for trends that last weeks or months to complement your fundamental analysis; ignore 5-minute intraday fluctuations.

- Combine With Fundamentals: Always cross-check chart signals against the company’s long-term growth prospects, cash flow potential, and industry position.

Key Takeaway: Charts are mirrors of psychology and expectation, not magic predictors.

The Critical Takeaway

Price action is not a real thing. A spike, a wick, or a five-minute candle does not create wealth; it only shows where short-term liquidity is absorbed. Market makers absorb the noise from scalpers, momentum chasers, and intraday traders. They do not “play” against you they facilitate real holders and long-term sellers. Even temporary dislocations are fleeting, not signals of opportunity.

True profits come from understanding the business, its fundamentals, and expectations about its future. Prices move because real holders revise expectations, not because candles form patterns. Intraday noise is irrelevant. Short-term trading is a fool’s game.

As Benjamin Graham’s Mr. Market reminds us, the market is a moody partner: sometimes euphoric, sometimes despondent, offering prices that have little to do with the underlying business. If you let him dictate your decisions day to day, you are gambling, not investing.

Focus on value, patience, and the interplay between fundamentals and expectations that is where lasting wealth is created, not in chasing spikes or wicks.

Leave a comment