London, Early 1920s

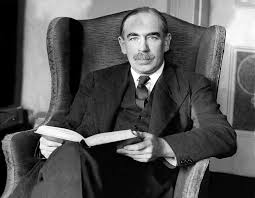

The trading floors buzzed with chatter, the shuffle of papers, and the sharp scent of ink and cigar smoke. John Maynard Keynes walked through it all with the quiet confidence of a man who believed reason could bend the market to his will.

After all, this wasn’t just any economist. Keynes had reshaped economic theory, influencing how governments thought about money, interest, and cycles. If anyone could outsmart the market, it was him.

The Bold Bets

Keynes made ambitious wagers. He speculated on currencies and commodities — wheat, cotton, lead, copper, rubber, tin — placing leveraged bets he believed reflected inevitable post-war normalization. At first, the market seemed to follow his logic. Quick gains reinforced his confidence.

But markets don’t obey theories. Weather, politics, liquidity, and human behavior tug prices in ways no model can predict. Timing slipped. Gains reversed. Losses mounted.

By 1928, Keynes faced a humbling truth: brilliance alone could not conquer a system with too many moving parts. His once-thriving portfolio was devastated.

The Pivot

Yet this setback became a turning point. Keynes shifted focus from predicting macroeconomic trends to investing in businesses he could understand. Instead of chasing cycles, he concentrated on companies with durable earnings, capable managers, and real economic value.

This approach worked. Managing King’s College’s endowment in the 1930s and 1940s, Keynes’ bottom-up strategy consistently outperformed the broader market. He stopped forcing markets into his models and let businesses compound value over time.

Adaptation Over Ego

Keynes’ greatest strength wasn’t just intellect — it was flexibility. He changed his mind when reality demanded it. Avoiding denial is critical in investing. Clinging to broken theories magnifies losses; clear-eyed adaptation preserves capital and creates opportunity.

The Value Investing Lesson

Real wealth comes from understanding businesses, protecting downside with a margin of safety, and letting time compound value. Speculative bets on trends rarely endure. Keynes’ pivot mirrors the philosophy of investors like Warren Buffett: focus on fundamentals, stay disciplined, and remain patient.

What’s Next

Keynes’ story reminds us that even the smartest can falter when theory meets reality. Next, we’ll examine the Efficient Market Hypothesis — the claim that markets are always “right” — and explore what it really tells us about how markets behave.

Leave a comment