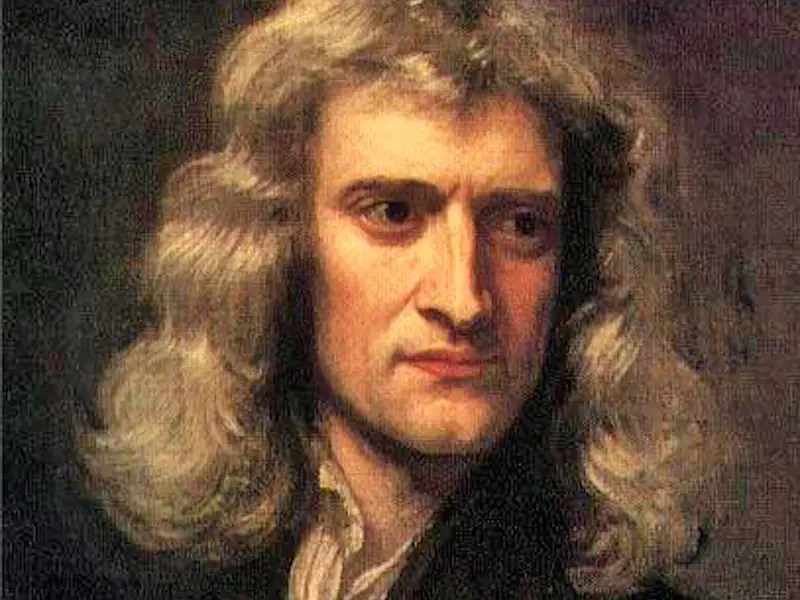

Newton vs the Market: A Lesson from the South Sea Bubble

London, June 1720

The door of Jonathan’s Coffee House swung open, letting in warm summer air and the faint tang of horse manure from Change Alley. Inside, the room buzzed with chatter, pipe smoke, and clinking tankards. At one table, a merchant waved a scrap of paper like a victory flag.

“South Sea! Nine hundred a share, and climbing! My cousin swears it will be a thousand by Michaelmas!”

Newton, sitting in the corner with a cooling cup of black coffee, kept his eyes on the newspaper but listened to the room. He had already played his hand in the South Sea Company months ago and walked away with a tidy profit. He was content. Or at least he thought he was.

Across the room, a young clerk in ink-stained sleeves boasted to an older man.

“Paid off my father’s debts, bought a carriage, and I am not done yet. All from South Sea shares! Even the fishmonger doubled his stake.”

The older man chuckled.

“And Newton, sir, I hear you were an early bird. But why sit idle now? This is history in the making!”

Newton offered a polite smile. His mind, once calculating the orbits of planets, now orbited something else. Numbers, acceleration, and the thought of what he might have made if he had stayed in.

By the time he stepped into the sunlight of Change Alley, the air was thick with shouts from street brokers. Sheets of share contracts fluttered in the breeze like birds escaping cages. The price kept climbing, and Newton felt the same pull he had once described in physics, an invisible, irresistible force.

Within days, he was back in, heavily this time.

But the market has its own laws, and gravity always wins.

By August, the South Sea price began a steep descent. Panic tore through London by September. Coffee houses emptied, and fortunes turned to dust. Newton’s own losses totaled £20,000, a lifetime’s wealth gone in months.

He would never again invest in the markets. Years later, he wrote a line sharper than any theorem.

“I can calculate the motions of the heavenly bodies, but not the madness of people.”

More than two centuries later, Benjamin Graham would echo the same lesson. The stock market is not a test of intelligence but of temperament. Newton mastered gravity, but in 1720, he learned the force of human greed could pull even the greatest mind straight back down to earth.

Lesson for Investors Today

Markets are driven by human behavior, not logic

Early profits can create temptation, resist the pull

Even brilliant minds fall when greed and fear take over

Temperament matters more than intelligence

Leave a comment